Maximum Annuitant/Owner Issue Age: 90

Pacific Income Provider ®

A Single-Premium, Immediate Fixed Annuity

Pacific Income Provider provides predictable income that starts within one year of contract issue, and pays out over one life, two lives, or for a specified time period.

Client Profiles

Consider Pacific Income Provider for conservative pre-retirees and retirees who:

- Want predictable income beginning within a year.

- May want the option of income that adjusts for inflation or changes at a specified future date.

Key Features

Annuity Income Options (Fixed Annuitization Only)

Clients can choose one of a variety of annuity income options to create the income they need. The income option and frequency of payments (monthly, quarterly, semiannually, or annually) is set at contract issue and cannot be changed. The minimum annuity income payment amount is $250. Income payments must begin within one year of purchase.

Period Certain Option

- Up to 30 years1

Single Life Options

- Life Only

- Life with Period Certain (up to 30 years1)

- Life with Cash Refund

- Life with Installment Refund2

Joint Life Options3

Income payments can be reduced to 50%, 67%, or 75% of the current income payment upon the death of either annuitant.

- Joint Life Only

- Joint Life with Period Certain (up to 30 years1)

- Joint Life with Cash Refund

- Joint Life with Installment Refund2

Joint and Survivor Life Options3

Income payments can be reduced to 50%, 67%, or 75% of the current income payment upon the death of the primary annuitant.

- Joint and Survivor Life Only

- Joint and Survivor Life with Period Certain (up to 30 years1 )

- Joint and Survivor Life with Cash Refund

- Joint and Survivor Life with Installment Refund2

Optional Features

Future Adjustment Option

A one-time increase or decrease in payments based on an anticipated event.

- Increase by up to three times the initial payment or decrease by up to half the initial payment.4

- Amount and effective date of increase or decrease must be selected at issue.

- Not available with Joint Life income options when a reduced benefit has been elected.

Inflation Protection Option

Must be elected at issue. Annual increase in payments of 2%, 3%, or 4%.

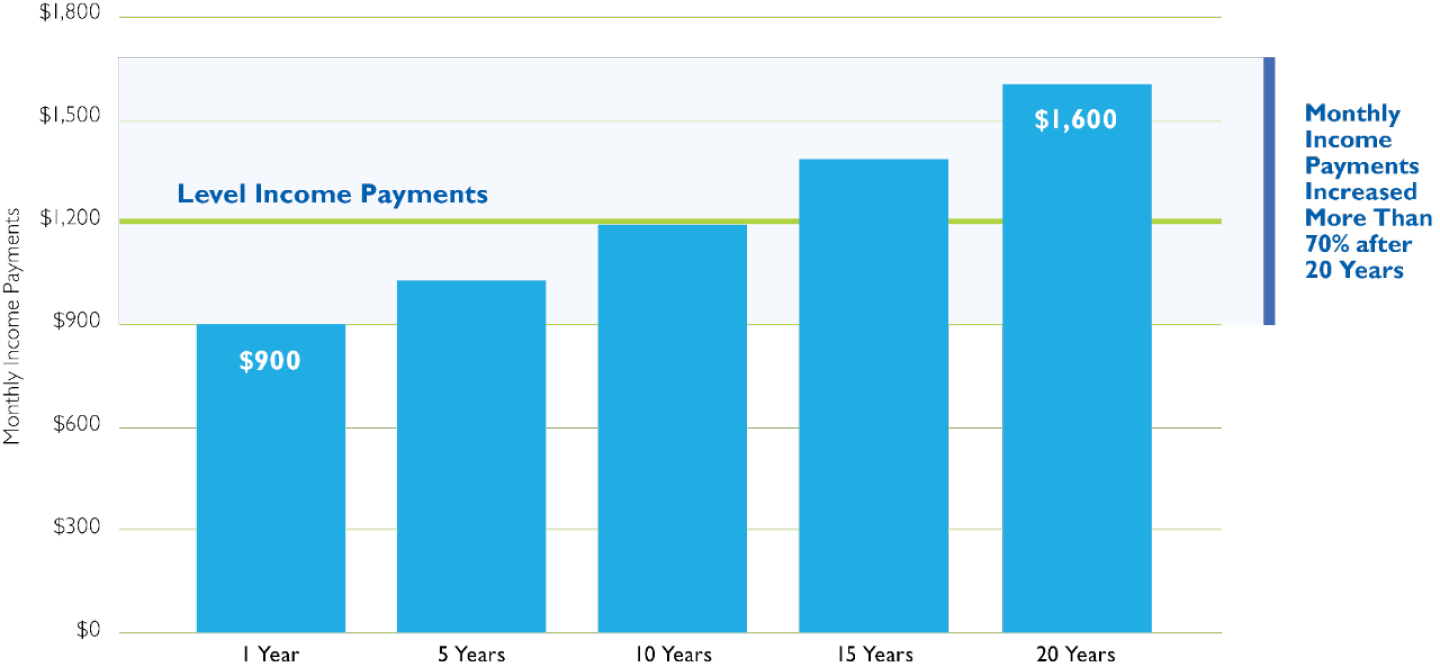

The following chart illustrates how the Inflation Protection Option with a 3% annual increase compares to level income payments over a 20-year period.

Hypothetical example. For illustrative purposes only. Assumes male age 65 purchases a Pacific Income Provider contract with a $282,646 purchase payment and elects the Single Life payment option and 3% Inflation Protection Option. Numbers in this example are rounded to the nearest $100. Your payments may differ.

Only one optional feature may be added to a Pacific Income Provider contract. Once the contract is issued, the elections made at the time of purchase cannot be changed.

Additional Information

Fixed Annuity Rates & Resources

For Financial Professionals

For Use With Clients

All guarantees are subject to the claims-paying ability and financial strength of the issuing insurance company.

1For qualified contracts, the maximum length of time for the Period Certain options may not exceed 10 years (9 years for inherited IRA), if necessary, to comply with required minimum distribution (RMD) regulations for annuities stipulated in the Setting Every Community Up for Retirement Enhancement (SECURE) Act.

2Not available on qualified contracts.

3For IRA, Roth IRA, and SEP-IRA contracts, joint annuitants are limited to either a spouse, or individual older than or no more than 10 years younger than the primary annuitant.

4An increasing future adjustment is not available for qualified contracts.

Broker/dealer and state variations may apply. Contact your broker/dealer for availability.

Qualified contracts, including traditional IRAs, SEP-IRAs, Roth IRAs, inherited IRAs, and inherited Roth IRAs, are eligible for favorable tax treatment under the Internal Revenue Code (IRC). Certain payout options and certain product features may not comply with various requirements for qualified contracts, which include required minimum distributions and substantially equal periodic payments under IRC Section 72(t). Therefore, certain product features, including the ability to exercise withdrawal features, may not be available or may have additional restrictions. The payment acceleration feature is available, but will be considered a modification to the 72(t) program and may subject the series of 72(t) withdrawals to an additional 10% federal income tax. In addition, certain payout options may not be available for qualified contracts.

For Roth IRAs, upon the Roth IRA owner’s death, distributions to the designated beneficiaries may be subject to IRS required minimum distribution rules. If the designated beneficiary is not the spouse, the beneficiary may be required to take a lump-sum payment of the present value of the guaranteed payments if a death benefit becomes available. For the purpose of qualified distributions from a Roth IRA, since the five-year waiting period is tracked by the Roth IRA holder, the designated beneficiary and/or spouse who elects to treat the Roth IRA as his or her own will also need to take on this responsibility going forward when claiming qualified distributions.

Income from annuity payments received from Pacific Income Provider cannot be aggregated or combined with income from other IRA contracts/assets for purposes of satisfying the required minimum distributions.

Nonqualified contracts may not be subject to the various requirements for qualified contracts, but are still subject to an additional 10% federal income tax for annuity payments, withdrawals, and other distributions prior to age 59½. While there are exceptions to this additional federal tax under IRC Section 72(q), certain payment options may not comply. The payment acceleration feature may be considered a modification to the 72(q) program and may subject the series of 72(q) withdrawals, including any prior withdrawals, to an additional 10% federal income tax. For nonqualified contracts, an additional 3.8% federal tax may apply on net investment income.

FAQ0551-0324H