Invesco® V.I. Defined Outcome Funds

The flexibility to move when and how clients choose.

By offering the Invesco® V.I. Defined Outcome funds through a variable annuity, you have the opportunity to provide defined growth potential and loss protection. Clients have the flexibility to move in and out of the funds1 based on their needs and the current environment, plus, the option to review caps and buffers daily.

View Each Fund's Remaining Caps and Buffers

The Funds at a Glance

There are three important features to consider when selecting an Invesco® V.I. Defined Outcome Fund for your client.

Outcome Period

- One-year periods starting on each calendar quarter

- Initial cap and buffer stated at the beginning of each outcome period

Downside Protection Buffer

- Protection from the first 10% of index losses

- Remaining buffer varies during an outcome period

Growth Up to a Cap

- Maximum growth clients can earn in an up market

- Remaining cap varies during an outcome period

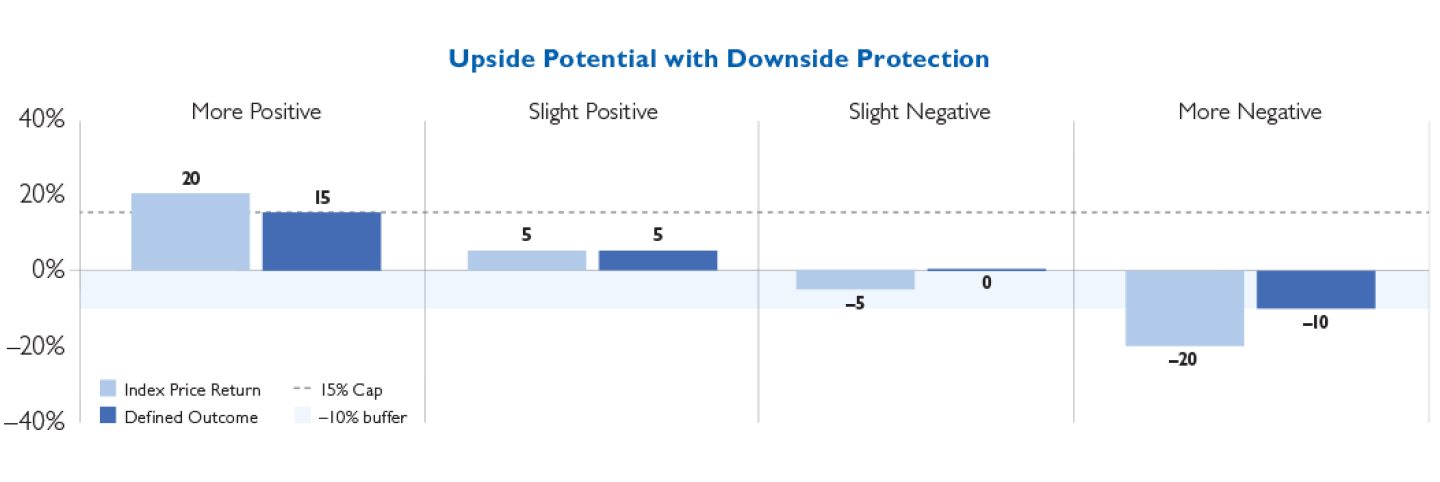

Designed to Provide Upside Potential with Downside Protection

Each fund is designed to capture market growth by tracking the price return of a market index (the S&P 500®) up to a maximum cap, while providing a buffer against losses. The buffer is designed to protect the first 10% of losses over a specific one-year outcome period. The buffer and cap are stated at the beginning of each outcome period. If your clients hold the fund through the entire outcome period, they can better define the outcome.

The above scenarios are hypothetical and for illustrative purposes only. They do not reflect a specific fund. You cannot invest directly in an index.

The cap rate used does not represent current cap rates available. A new cap is declared for each outcome period. For current rates and more fund details, visit Invesco.com/Defined-Outcome-II. The chart does not include any fees. Actual returns would be reduced by all applicable fees.

24-475A

VAC2279-0225

2/25 E927

1Transfers are limited to 25 for each calendar year. If you have used all 25 transfers available to you in a calendar year, you may no longer make transfers between the Investment Options until the start of the next calendar year. See prospectus for complete transfer/trade information.

The funds seek to provide a buffer against the first 10% of index price decreases over each outcome period, before fund expenses (the “Buffer”). The fund, and therefore investors, will bear all index losses exceeding 10%. There is no guarantee the fund will successfully buffer against index price decreases. The Buffer is designed to have its full effect only for investors who hold fund shares for an entire outcome period. For each outcome period, fund performance is subject to an upside return cap that represents the maximum percentage return the fund can achieve during the outcome period, before expenses (the “Cap”). The Cap is set on the first day of an outcome period and may increase or decrease from one outcome period to the next. If the index experiences returns over an outcome period in excess of the Cap, the fund will not experience those excess gains.

The “S&P 500® index” is a product of S&P Dow Jones Indices LLC or its affiliates (“SPDJI”), and has been licensed for use by Pacific Life Insurance Company. Standard & Poor’s® and S&P® are registered trademarks of Standard & Poor’s Financial Services LLC (“S&P”); Dow Jones® is a registered trademark of Dow Jones Trademark Holdings LLC (“Dow Jones”). Pacific Life’s product is not sponsored, endorsed, sold or promoted by SPDJI, Dow Jones, S&P, their respective affiliates, and none of such parties make any representation regarding the advisability of investing in such product(s) nor do they have any liability for any errors, omissions, or interruptions of the S&P 500® index.

Invesco® V.I. Defined Outcome Funds may not be available at all firms or in all states. The Invesco® V.I. Defined Outcome Funds are designed to produce predetermined investment outcomes relative to the performance of an underlying security or index. The defined outcomes sought by the fund include the Buffer and Cap (“Outcomes”) based upon the performance of the index over an outcome period. There is no guarantee that the Outcomes for any outcome period will be realized. A shareholder may lose their entire investment. The fund’s strategy is designed to produce the Outcomes on the last day of an outcome period for investors in the fund as of the beginning of the outcome period. It should not be expected that the Outcomes will be provided at any point prior to the end of an outcome period. The Outcomes are measured from the fund’s net asset value (the per share value of the fund’s assets (“NAV”)) on the first day of the outcome period. The fund does not track the index except over an entire outcome period, and the fund’s NAV will not increase or decrease at the same rate as the index during an outcome period. The caps and buffers do not include any product-level mortality, expense, administration or contract platform fees. The cap and buffer are reduced by these fees based on the daily fee rate and remaining days in the outcome period.

Insurance product and rider guarantees, including optional benefits and any fixed crediting rates or annuity payout rates, are backed by the financial strength and claims-paying ability of the issuing insurance company and do not protect the value of the variable investment options. They are not backed by the broker-dealer from which this annuity is purchased, by the insurance agency from which this annuity is purchased, or any affiliates of those entities, and none makes any representations or guarantees regarding the claims-paying ability of the issuing insurance company.