ESG (which stands for environmental, social, and governance), sustainability, and impact are terms most investors have heard often these days. The overarching concept seems simple enough: invest in companies that are making the world a better place so you can save for retirement while ensuring you have an Earth to retire in. Dig deeper, however, and many questions arise: How has ESG investing changed over time? How do I incorporate ESG into my portfolio? The information presented below aims to answer these questions so that you understand the current landscape of ESG investing and can make an informed decision on how to integrate it with your investment objectives.

Key Takeaways

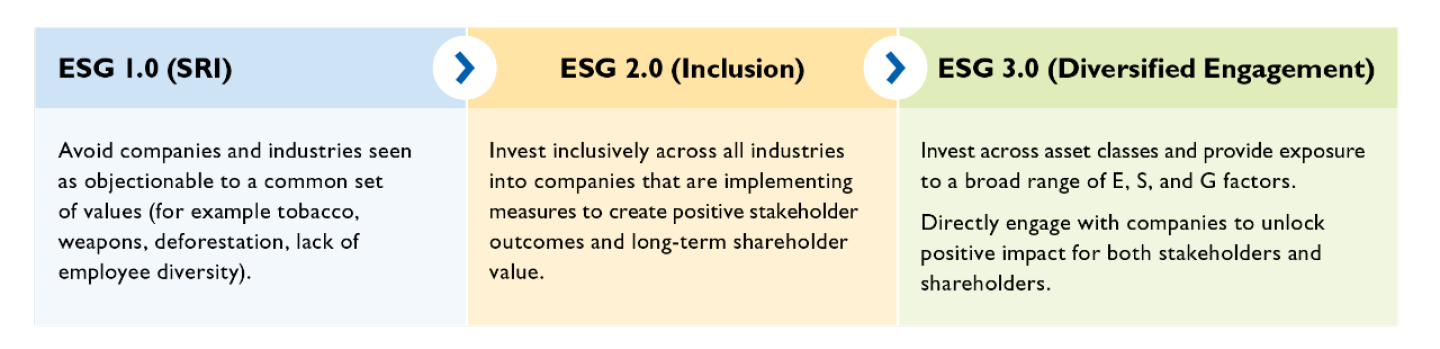

- ESG investing has been around since the 18th century but has rapidly evolved over last few decades. Modern ESG strategies invest inclusively across asset classes, regions, and industries while providing exposure to a broad range of sustainability factors.

- Demand for ESG strategies has likewise surged—rising to $17 trillion, or a third, of all professionally managed US assets.

- A standardized way of measuring various E, S, and G metrics remains elusive as all ESG raters have their own methodologies. Nonetheless, the industry’s growth will likely support the emergence of a uniform standard.

ESG Evolution: From Exclusion to Inclusion to Cross-Asset Engagement

Ethical investing is not a novel concept. Its origins can be traced back to the 18th century when John Wesley, the founder of the Methodist faith, outlined values-based investing principles in his The Use of Money sermon. In it, he said that “to gain money we must not lose our souls” and thus should not engage with businesses that may directly or indirectly harm our neighbors, even as we should seek to “gain all we can”. In today’s language we would say that Wesley advocated for achieving the highest risk adjusted level of return while limiting negative impacts to stakeholders.

This method of excluding, or screening out, companies that engage in practices not aligned with commonly held investor values is called SRI which stands for socially responsible investing. Since simply narrowing your investment universe can reduce diversification and lower risk-adjusted performance, most ESG detractors blame SRI for allegedly sapping returns. Yet, there are few modern ESG strategies that rely purely on negative screens. The figure below summarizes how ESG investing has evolved to offer comprehensive solutions for investors who want to generate competitive performance while producing a positive impact on the world.